Household Monthly Budget Template in Excel | Income vs Expense Tracker Spreadsheet

Household Monthly Budget Template in Excel | Income vs Expense Tracker Spreadsheet

Couldn't load pickup availability

Monthly household spending and income tracker (Georges Monthly Budget Spreadsheet v10) to help you cut expenses and save money. Easy steps to stay within your budget include: set your 12 month budget for all your income and expense categories. Enter your actual income and expenses in each of the monthly worksheets and compare your budget vs actual in charts and reports to make sure that you keep your budget and don't overspend.

Household budgeting tools key features: (watch video  below for overview)

below for overview)

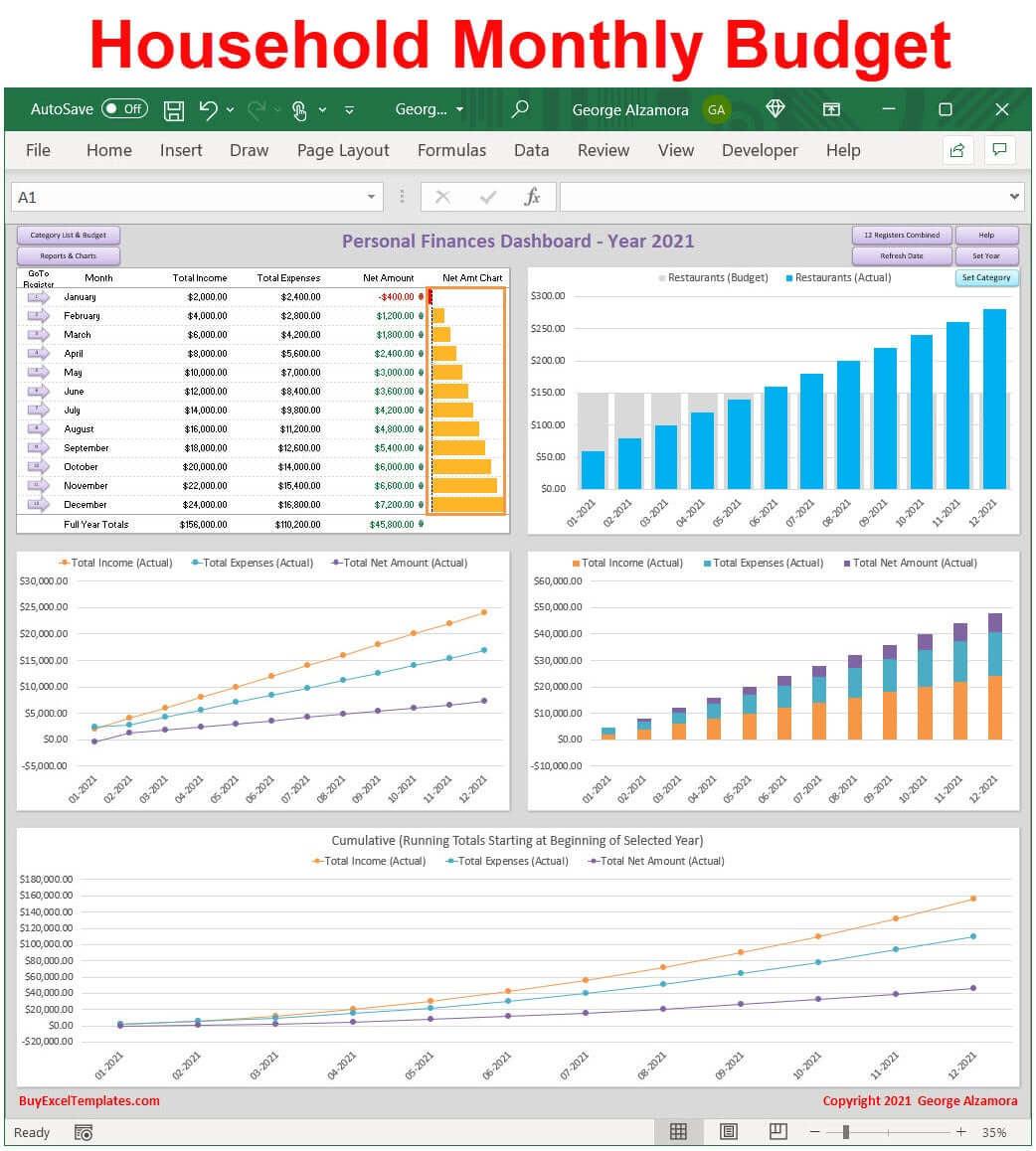

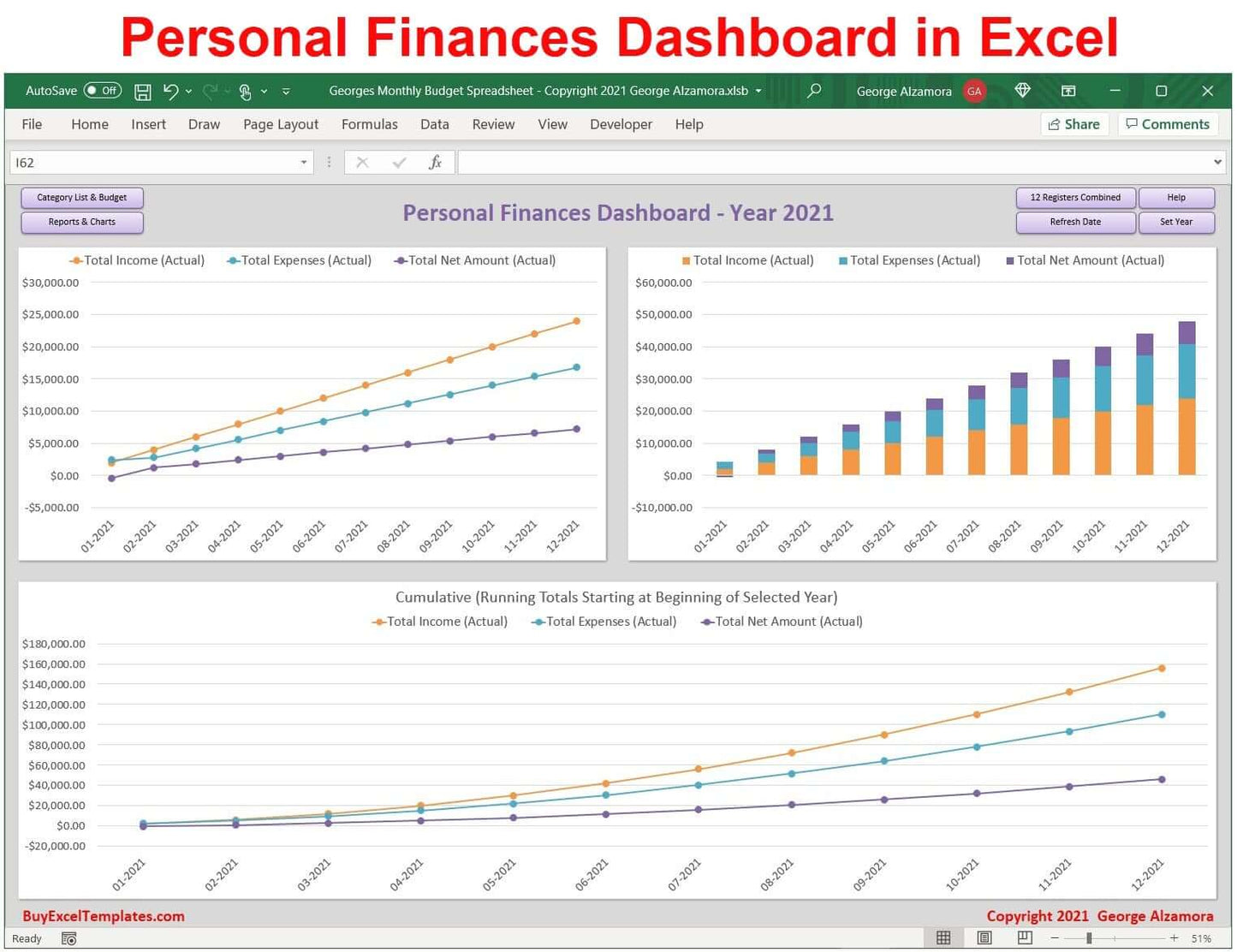

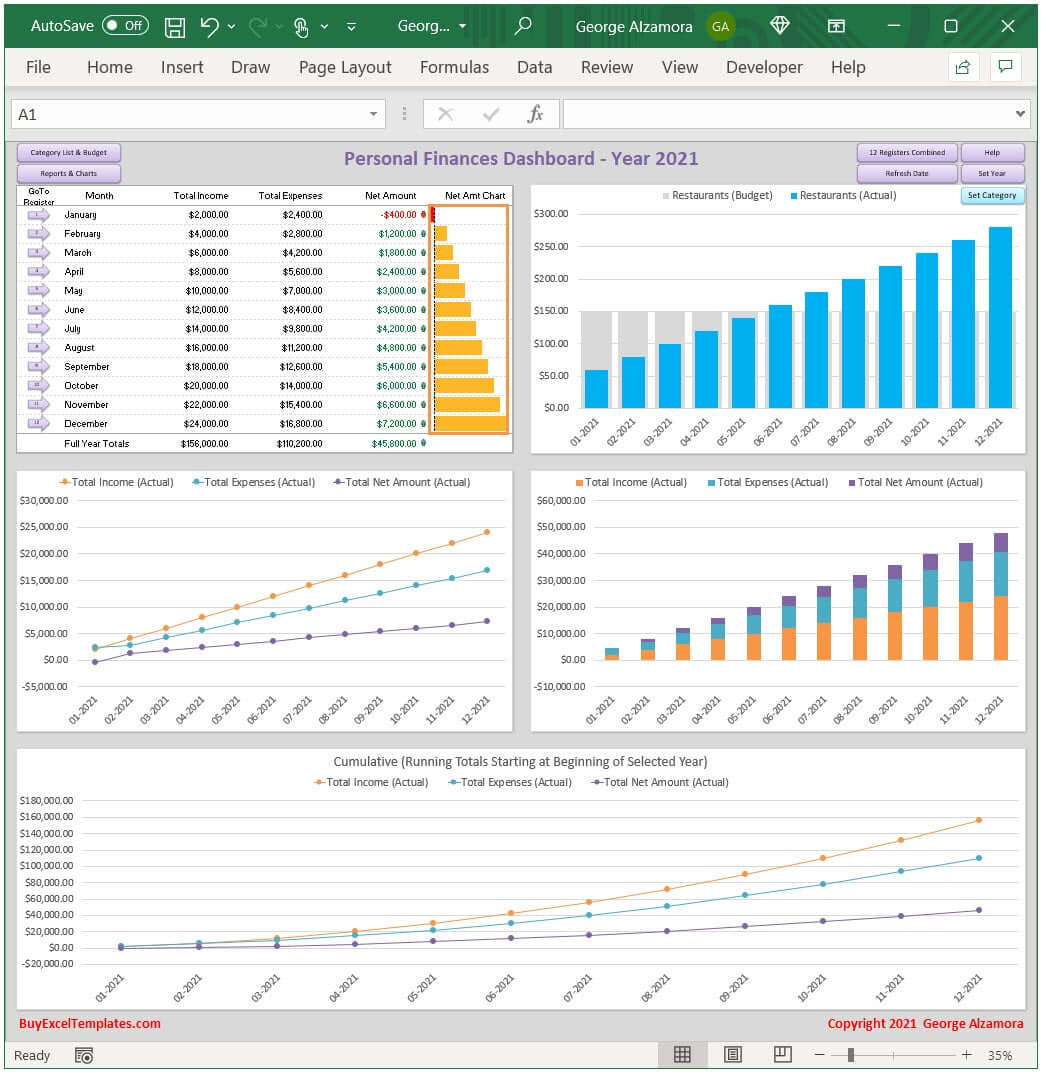

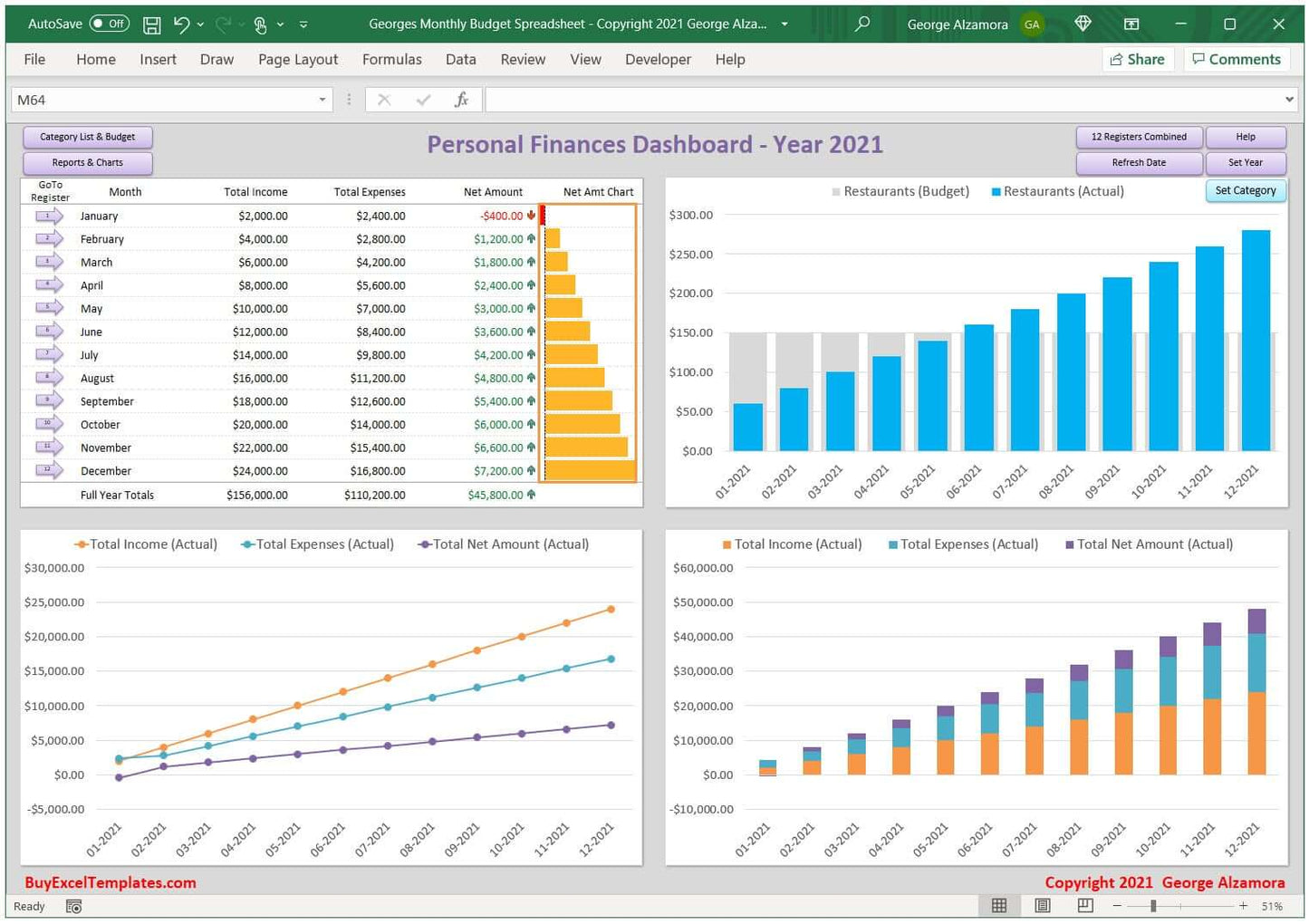

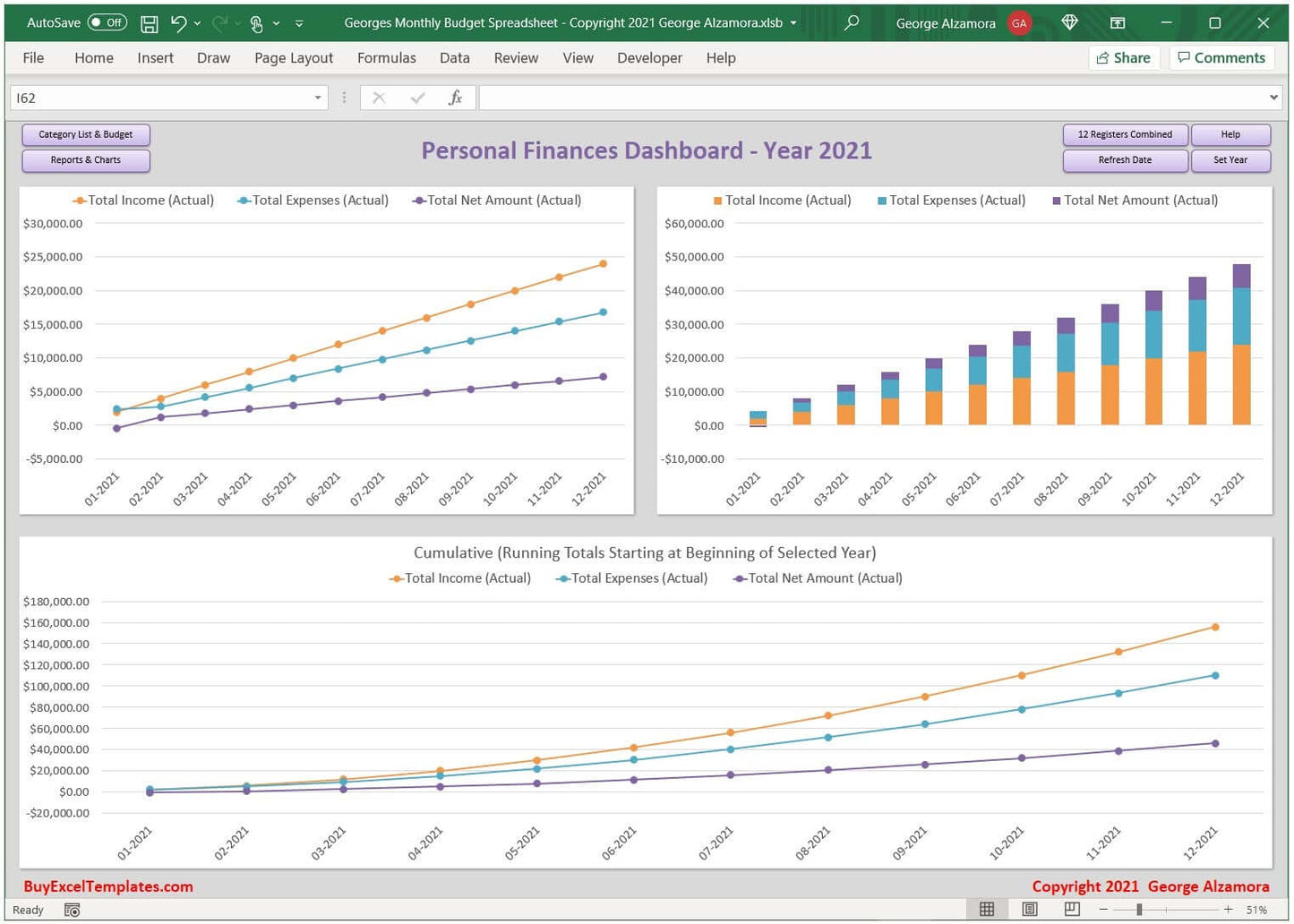

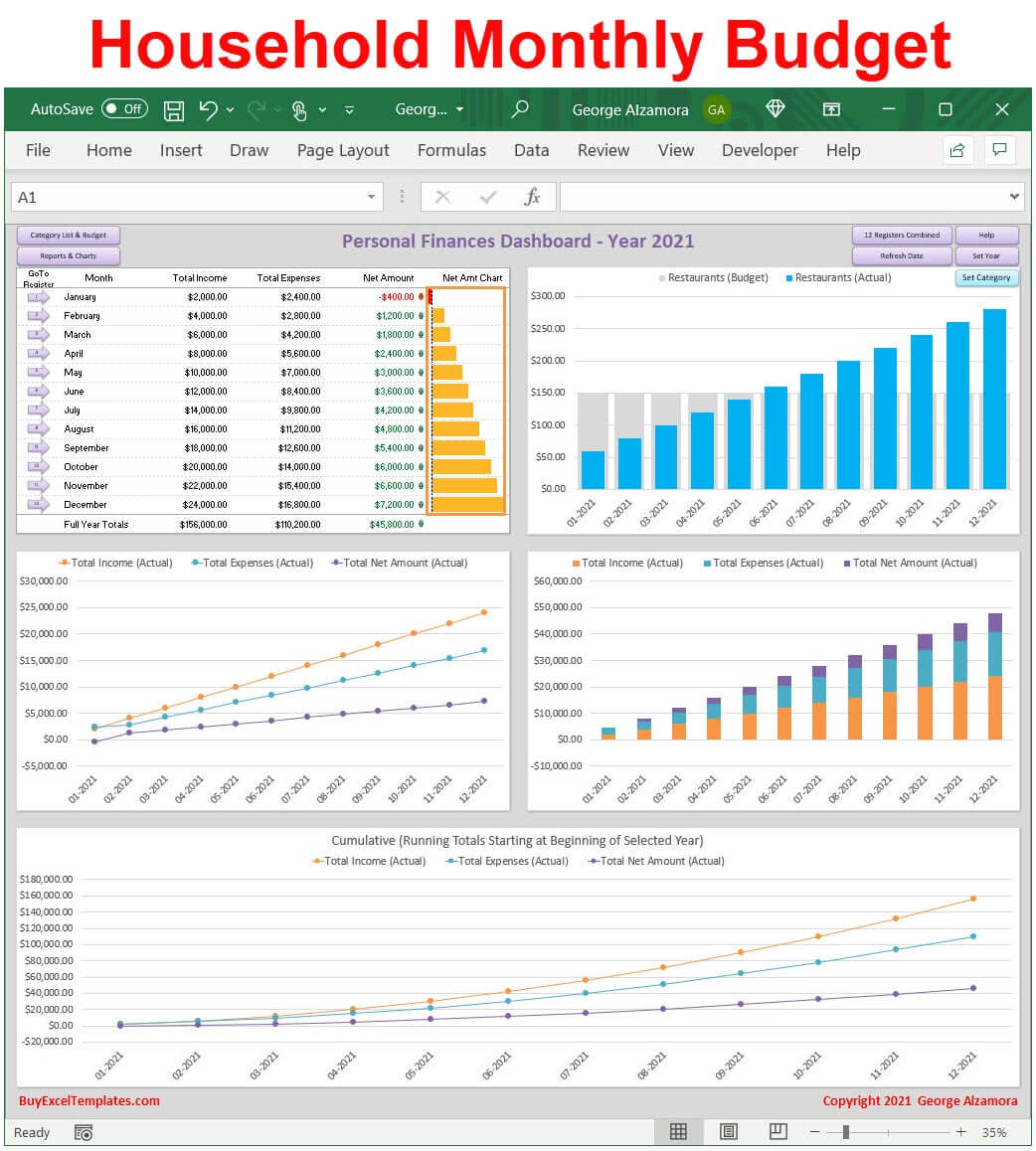

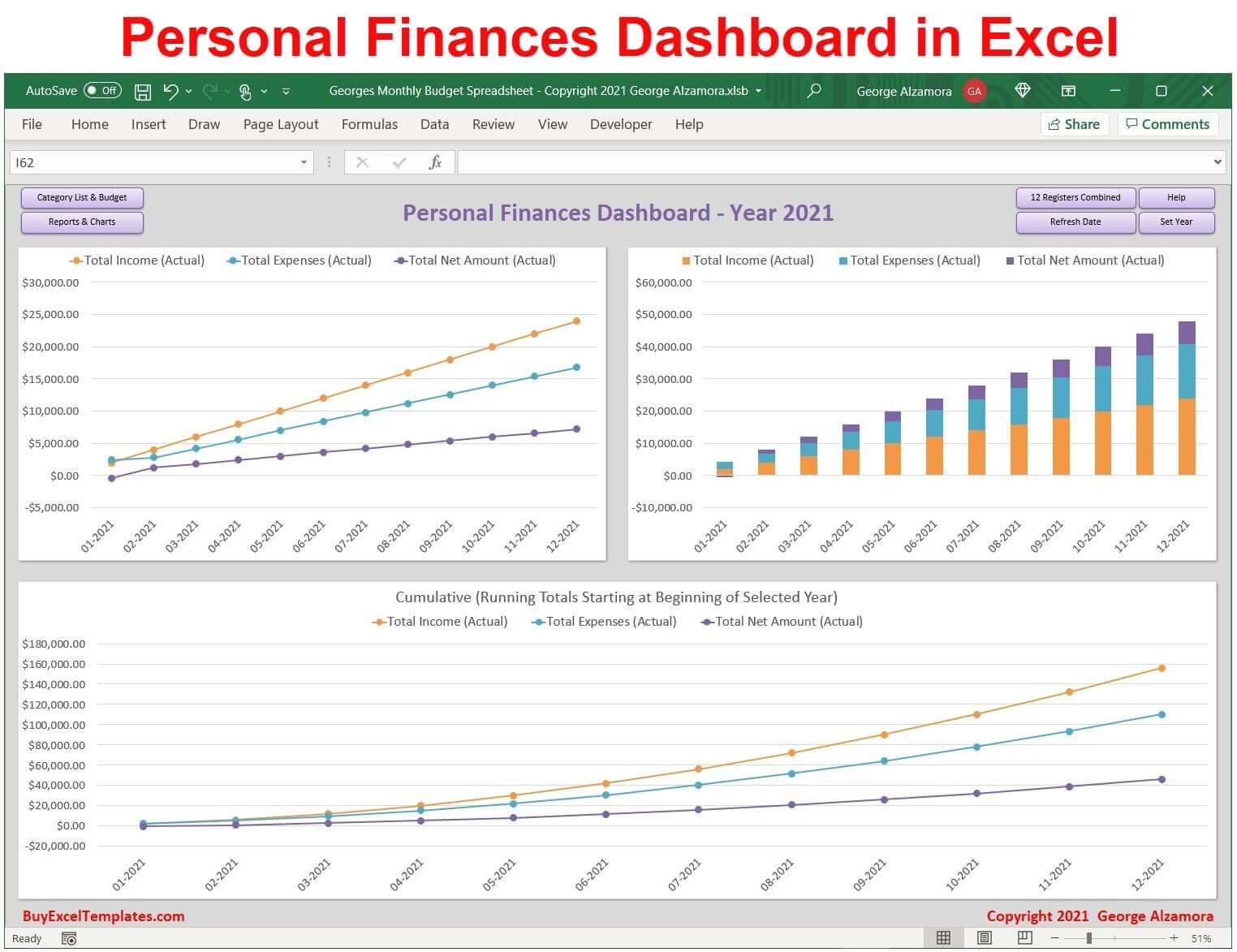

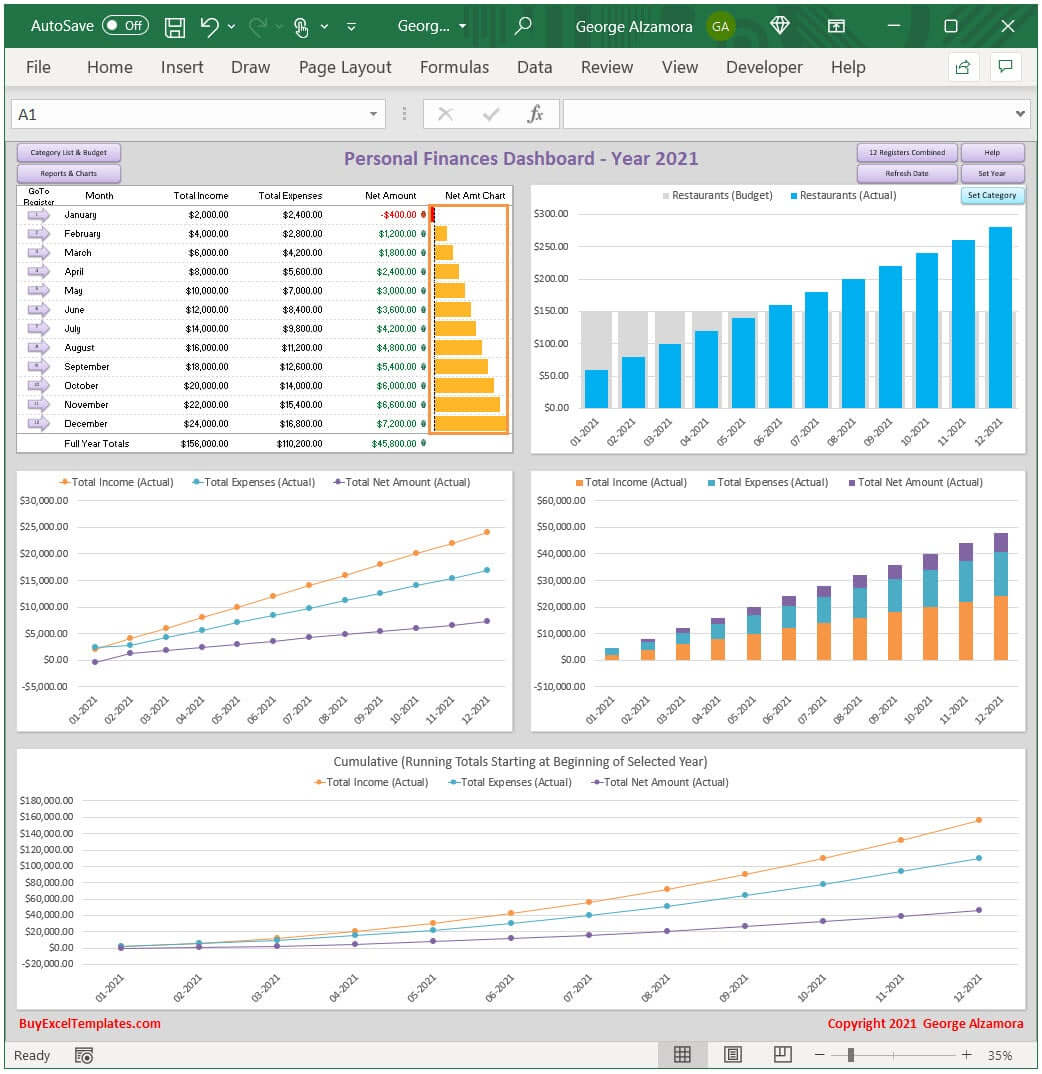

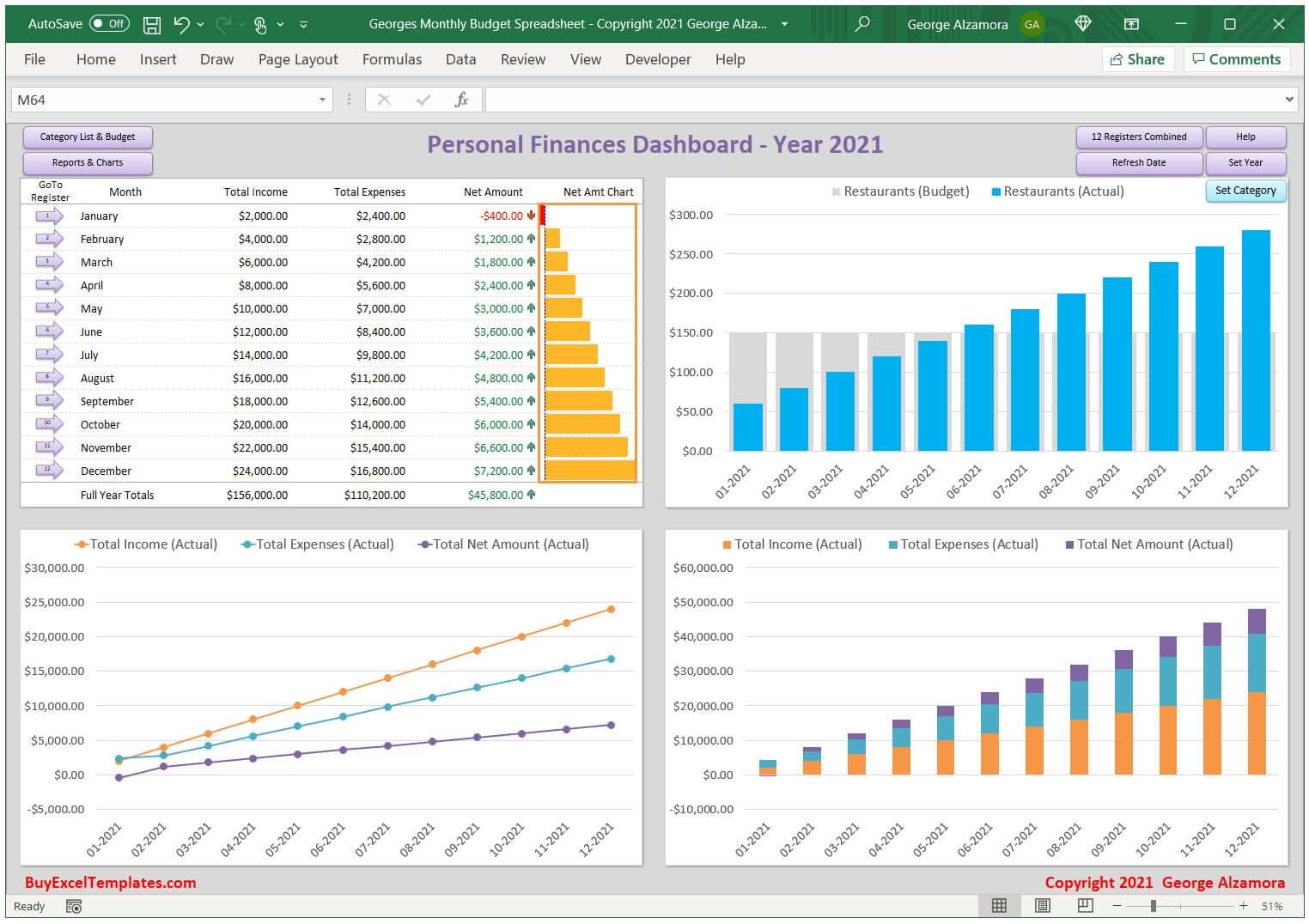

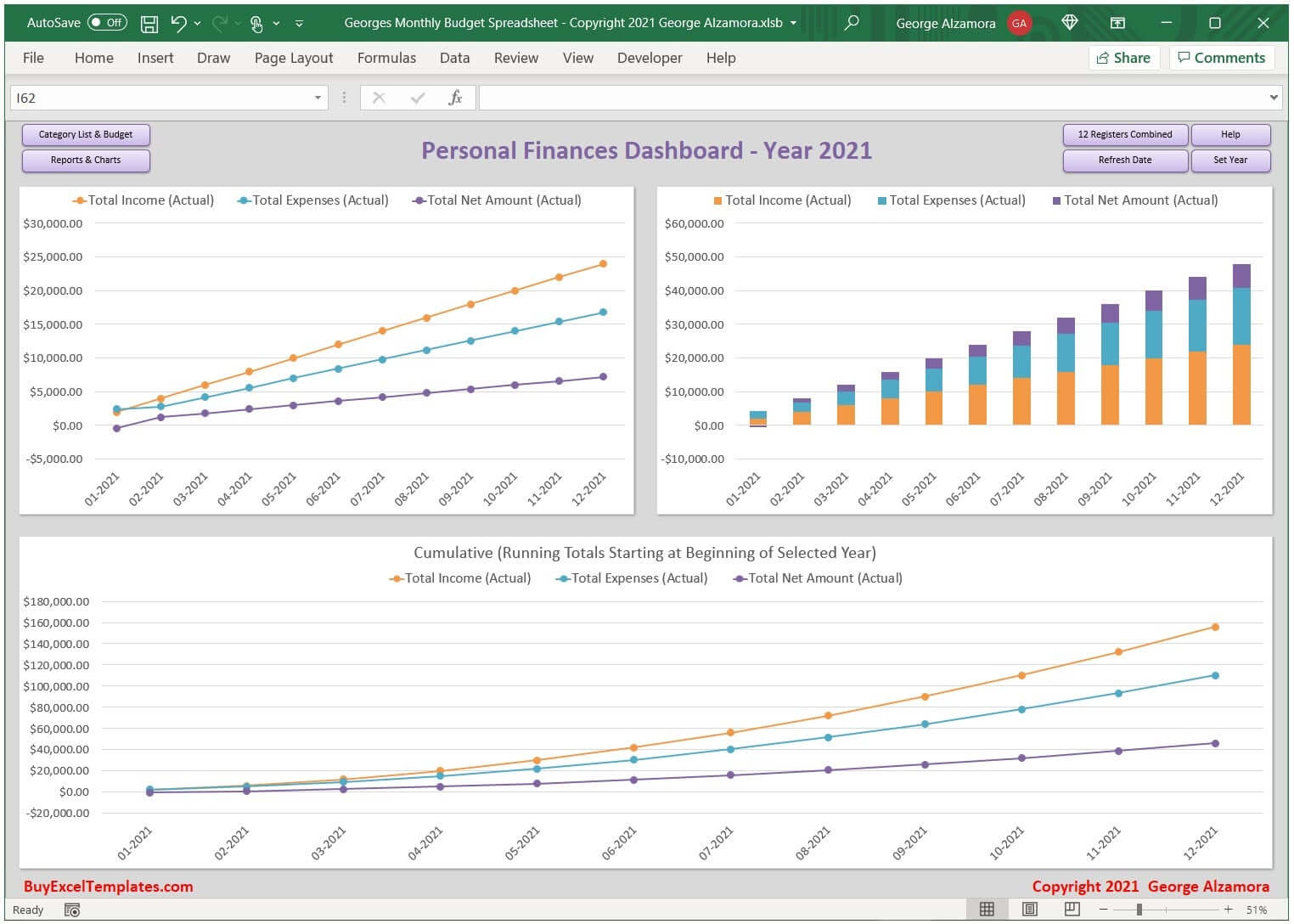

1. Excel Dashboard Summary with monthly income and expense totals / charts for an entire calendar year (including a chart with cumulative running totals) and a monthly budget vs actual chart of any category for an entire calendar year to see income and spending trends.

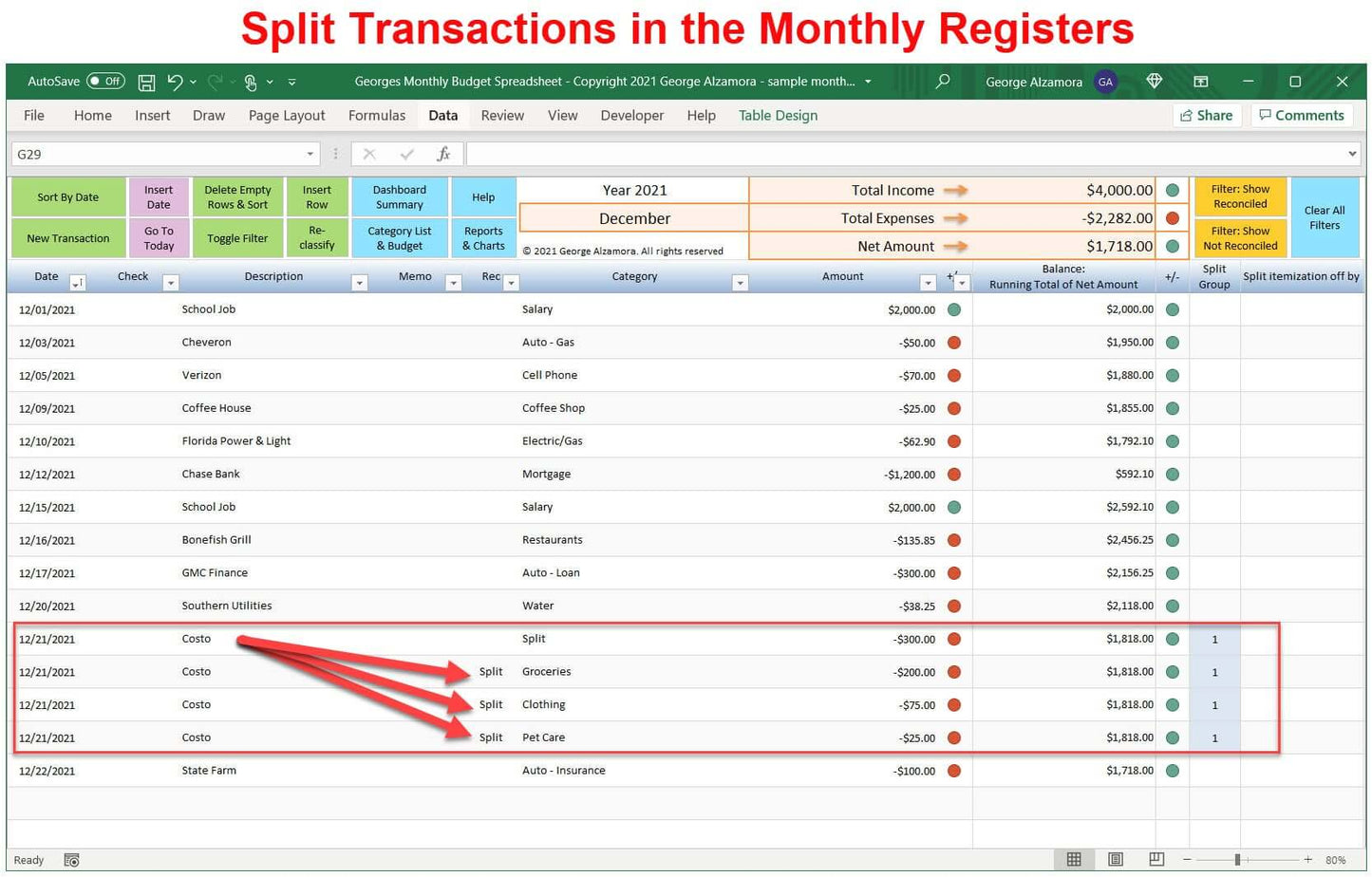

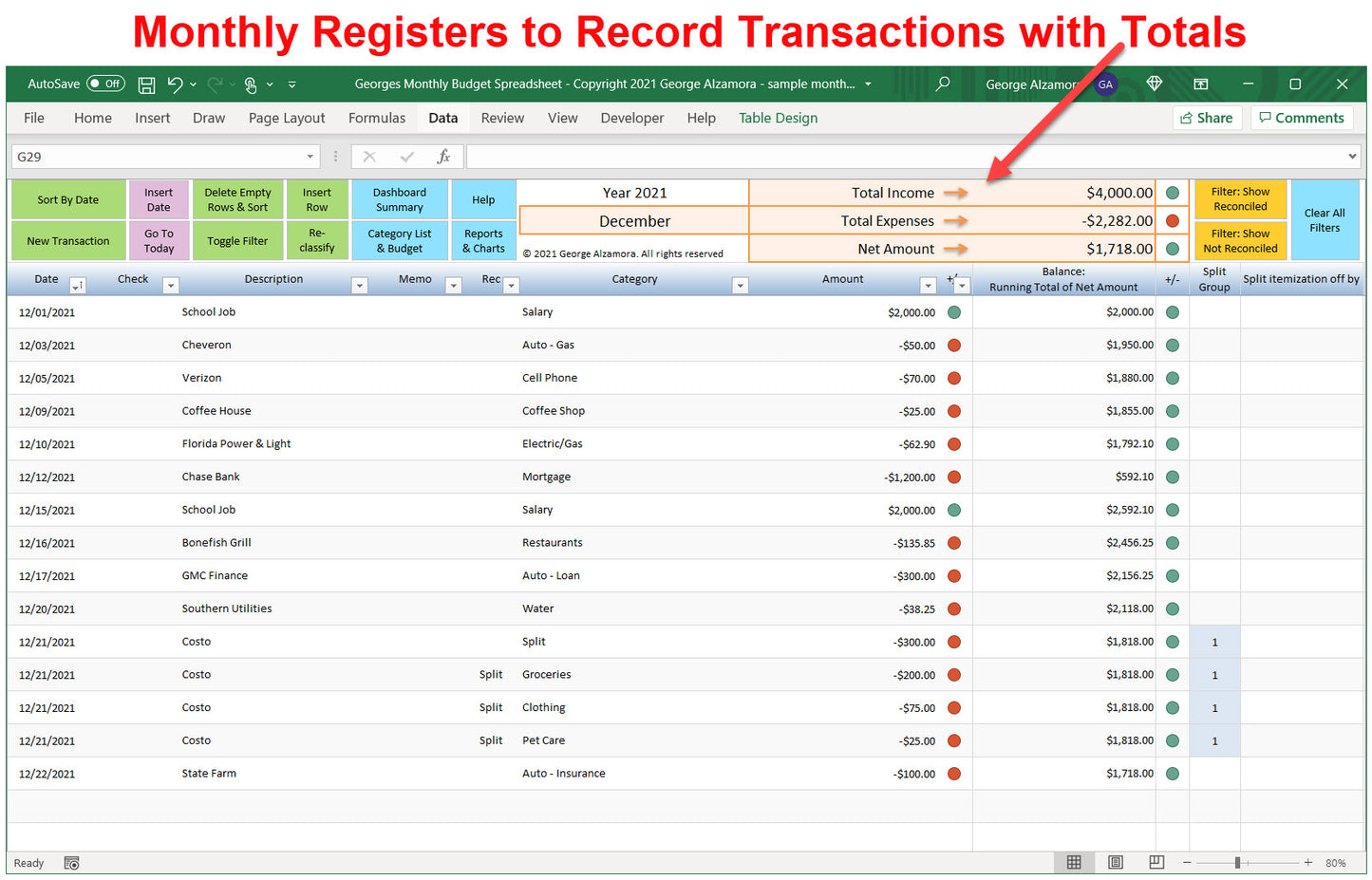

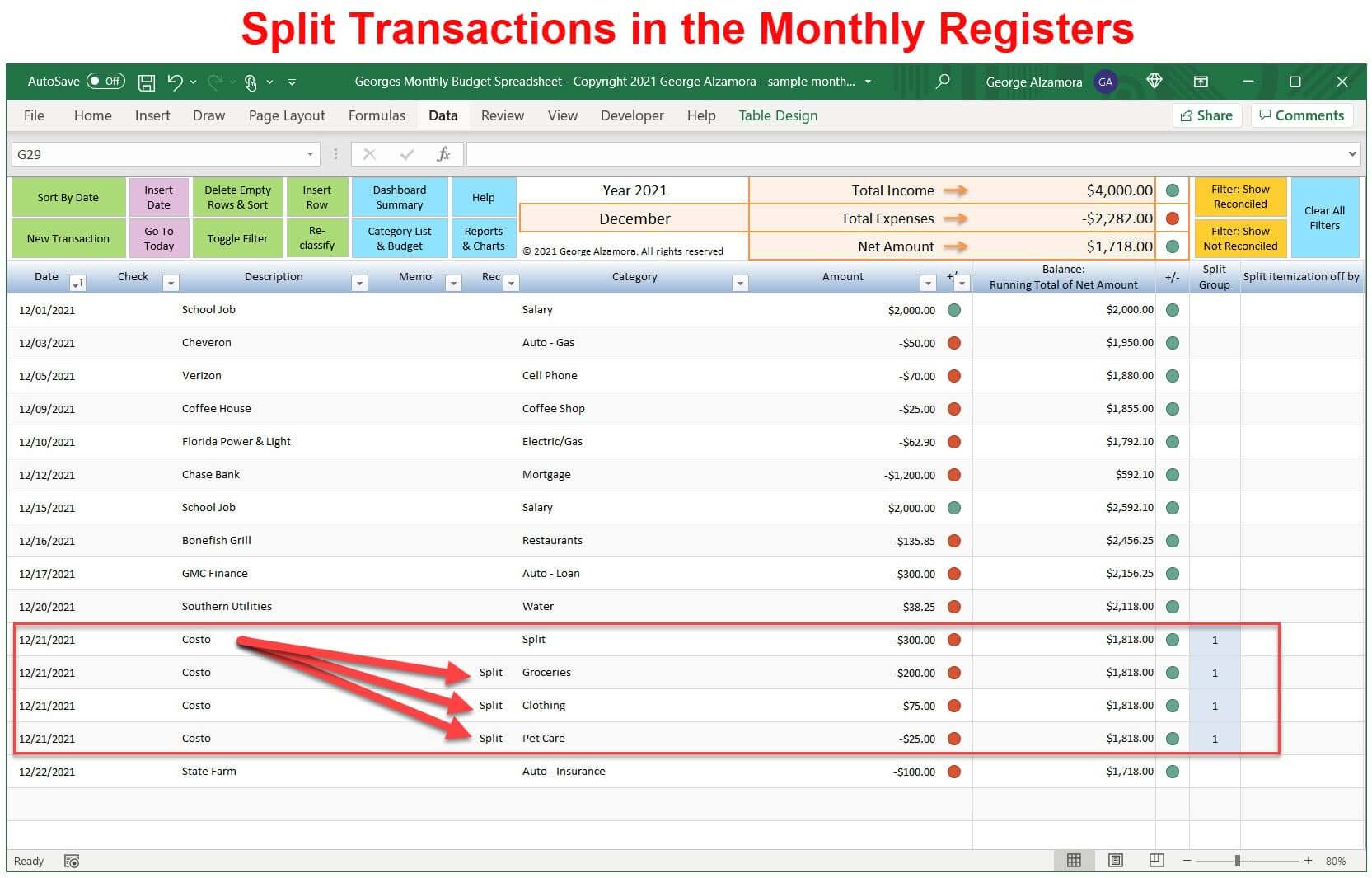

2. Twelve separate registers (one for each month of a particular calendar year) where you can enter individual income and expense transactions such as a specific purchase at a grocery store. These individual transactions are then automatically totaled in various reports and charts to get income, expense and category totals. In the monthly registers, you can sort transactions and easily enter a transaction's category from a drop down selection of custom categories that you created (In prior v4, you could only enter category totals not individual transactions/purchases.

3. Split Transactions: When entering transactions into one of the individual monthly registers, you can split the transaction into multiple categories. For example, if you went to Walmart and purchased groceries and clothing, when entering that purchase, you can split the total spent into two categories, a portion goes to the groceries category and a portion goes to the clothing category. Splitting a single transaction into more than one income or expense category allows you to better track your actual spending or income.

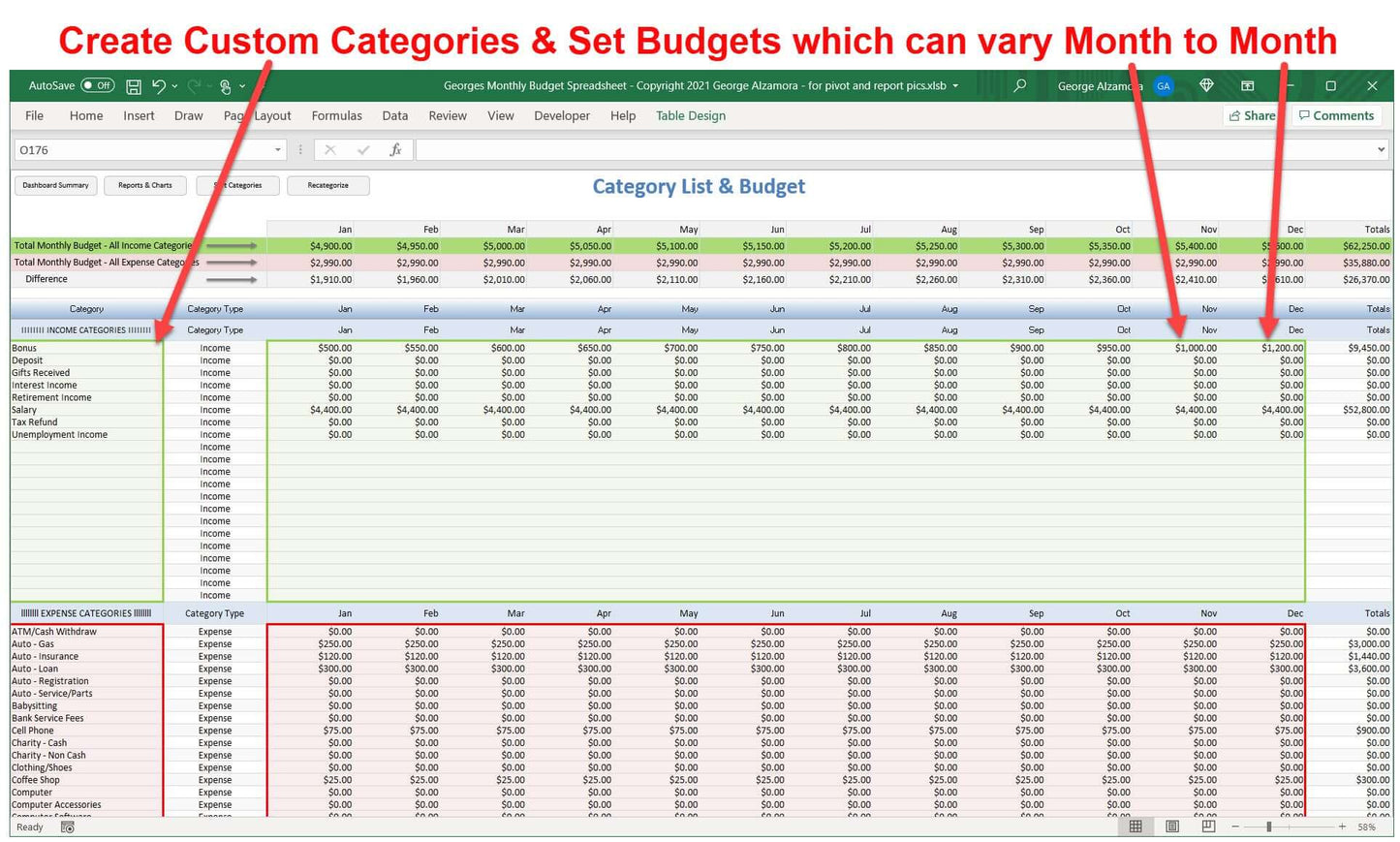

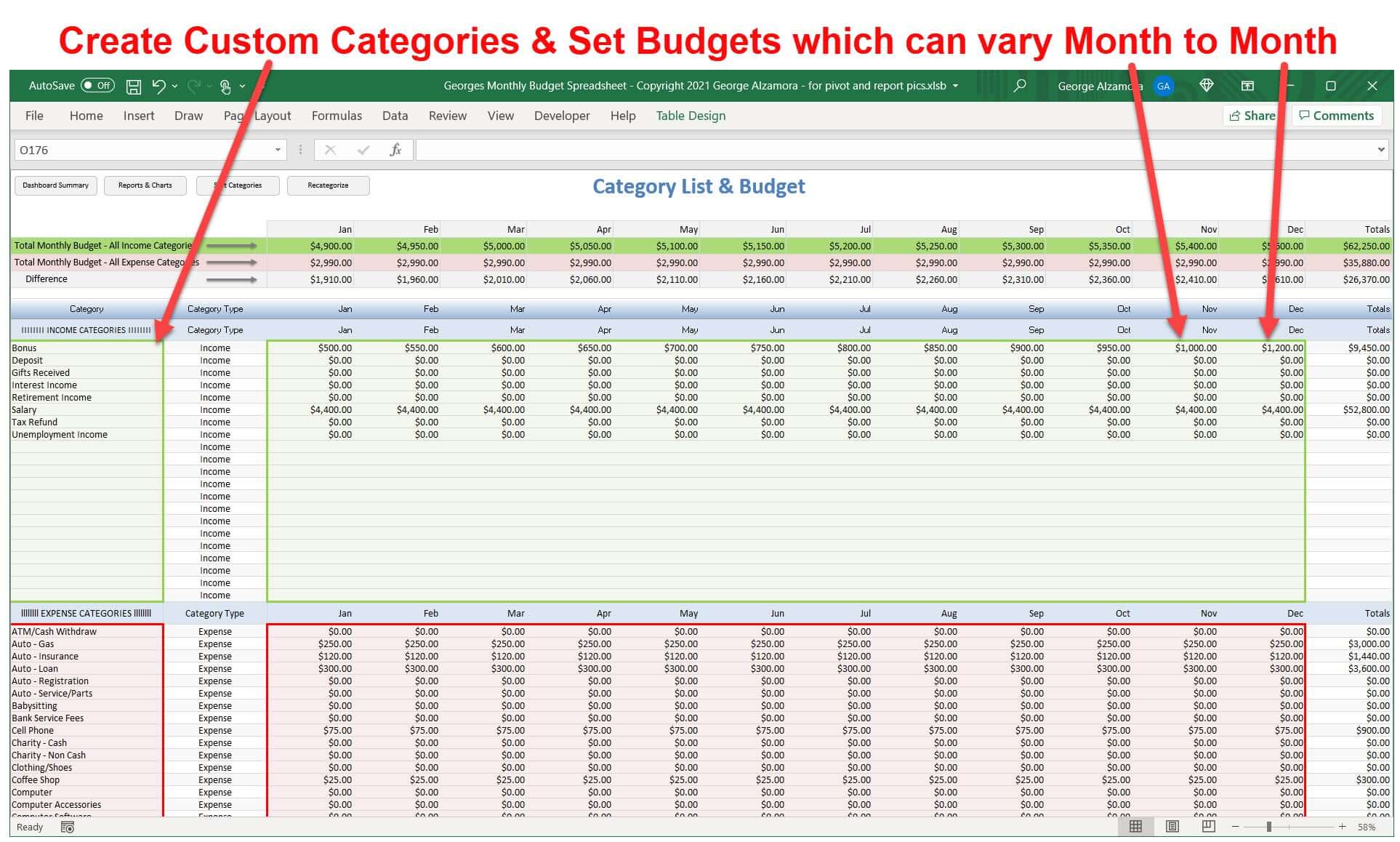

4. Category List and Budget section where you can add/delete your own custom categories, sort them, and add a budget amount for each custom category for each month of a particular calendar year. The budget amount for a particular category can be different for each month of the calendar year.

5. In the Category List and Budget section, you can add up to 50 custom income budget categories and up to 200 custom expense budget categories to track your actual vs budgeted income and expenses. (In prior v4, there was a max of 20 income budget categories and max of 120 expense budget categories)

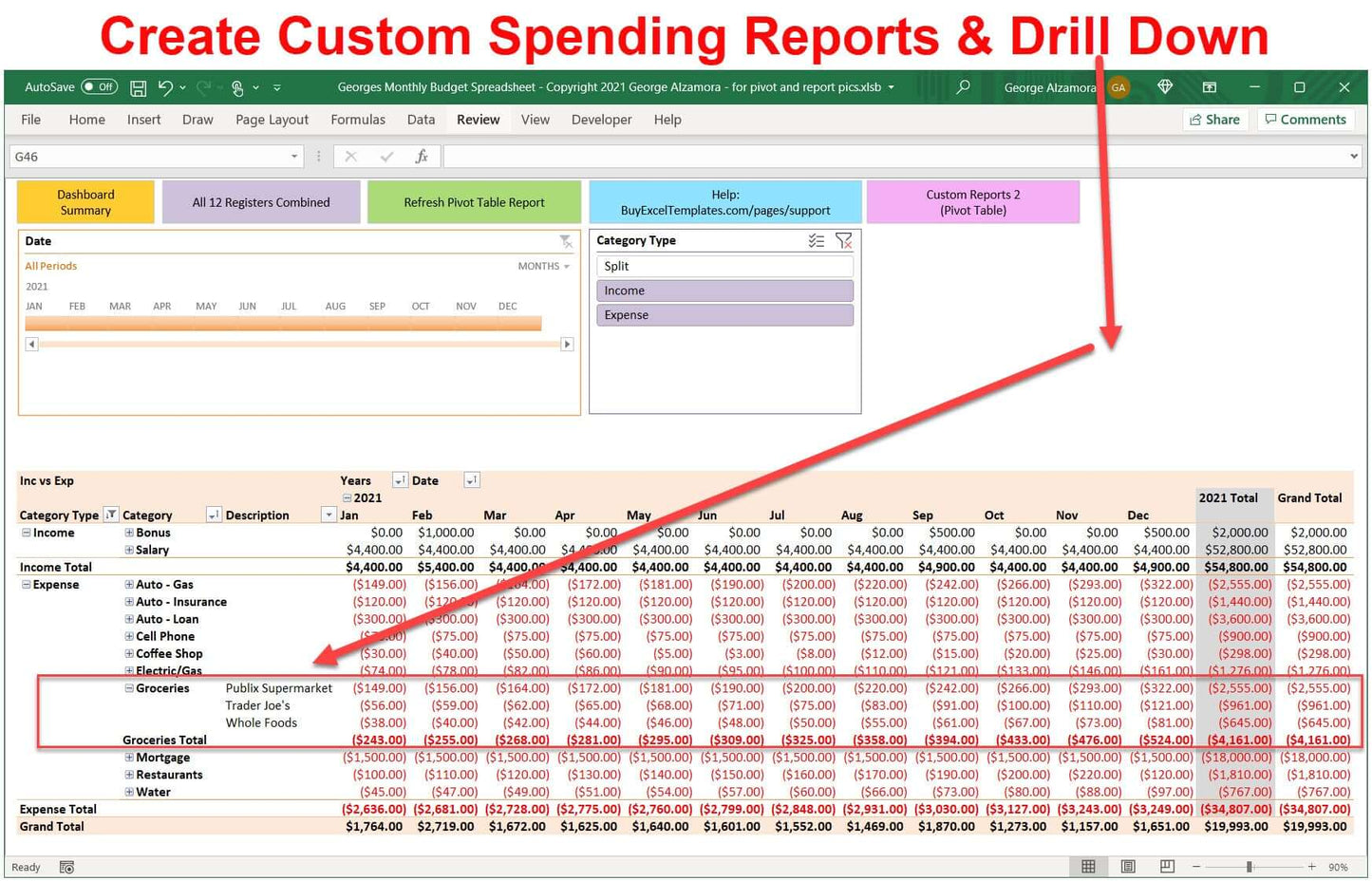

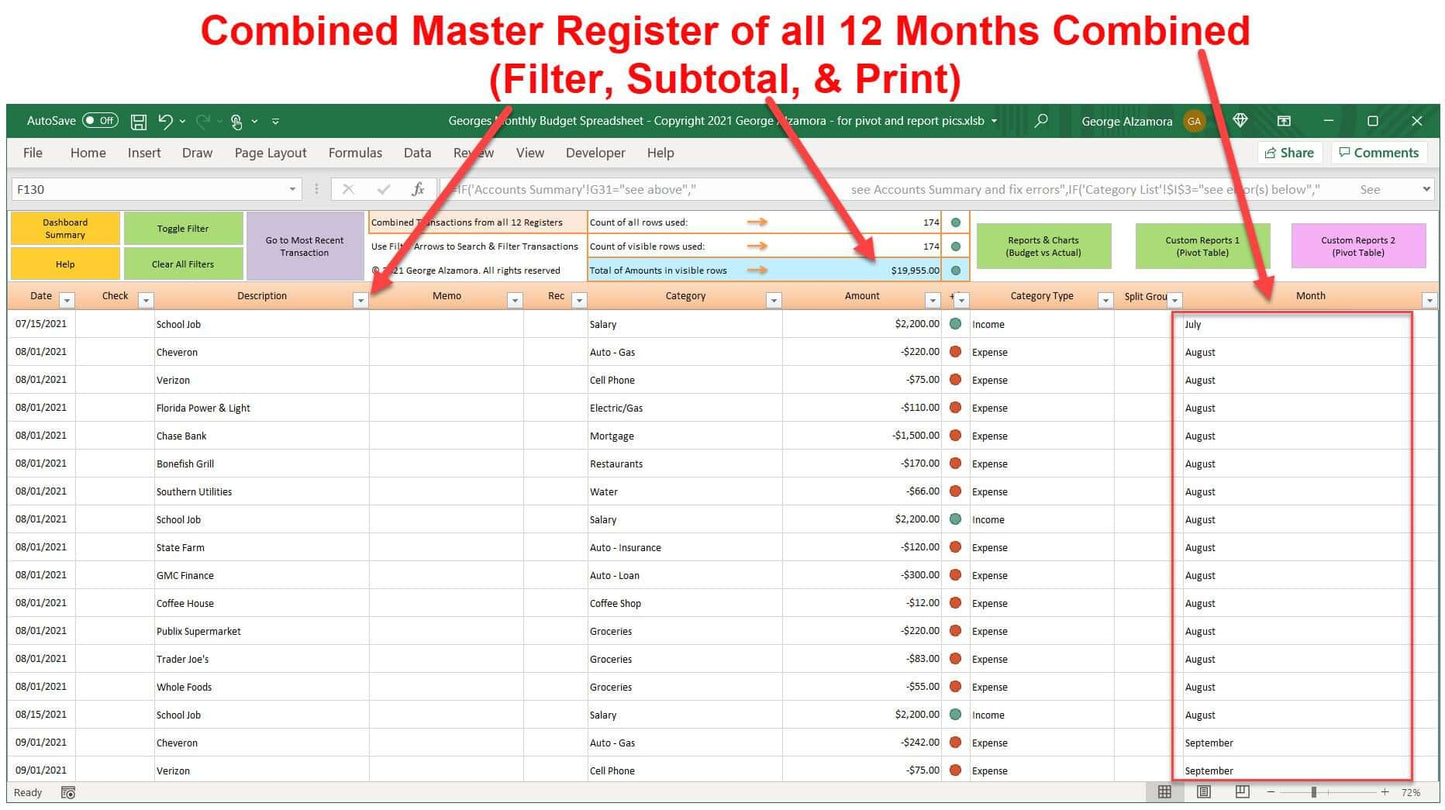

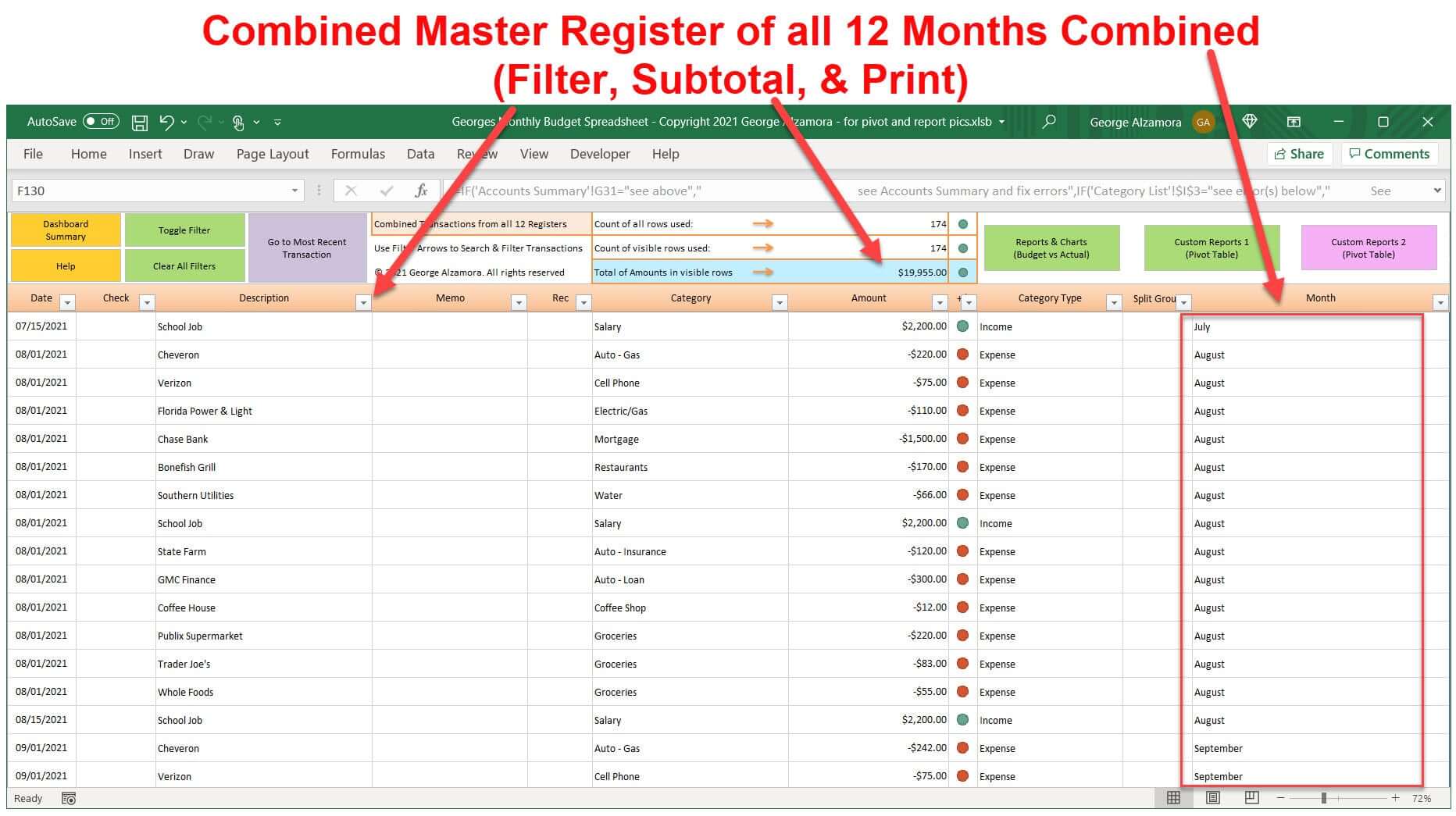

6. Combined master register of all transactions from all 12 separate monthly registers for an entire calendar year. You can use this combined master register to search, filter and get subtotals such as total spent on groceries across all 12 separate registers/months. This combined master register is automatically created as you enter transactions in one of the 12 separate monthly registers.

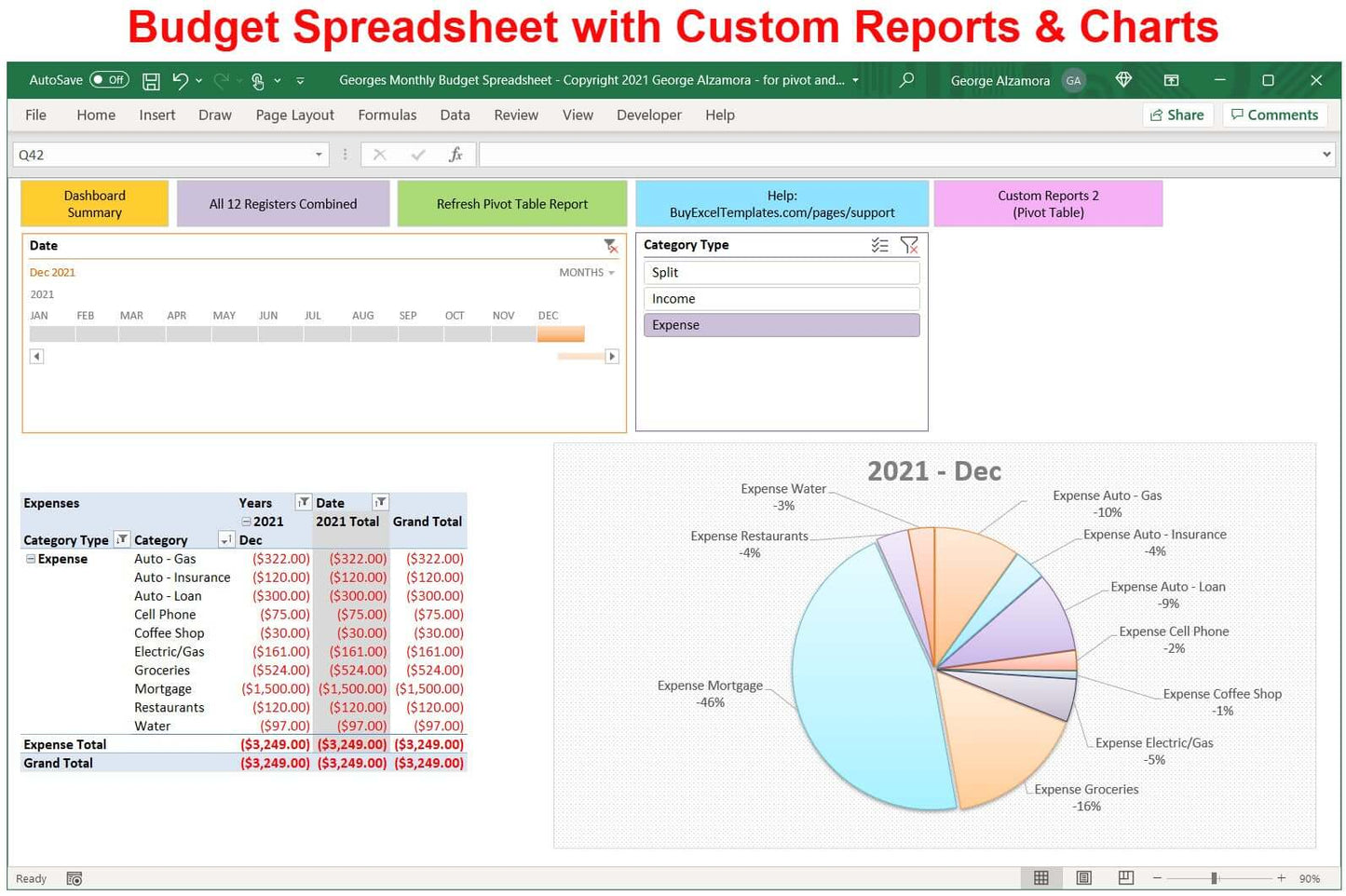

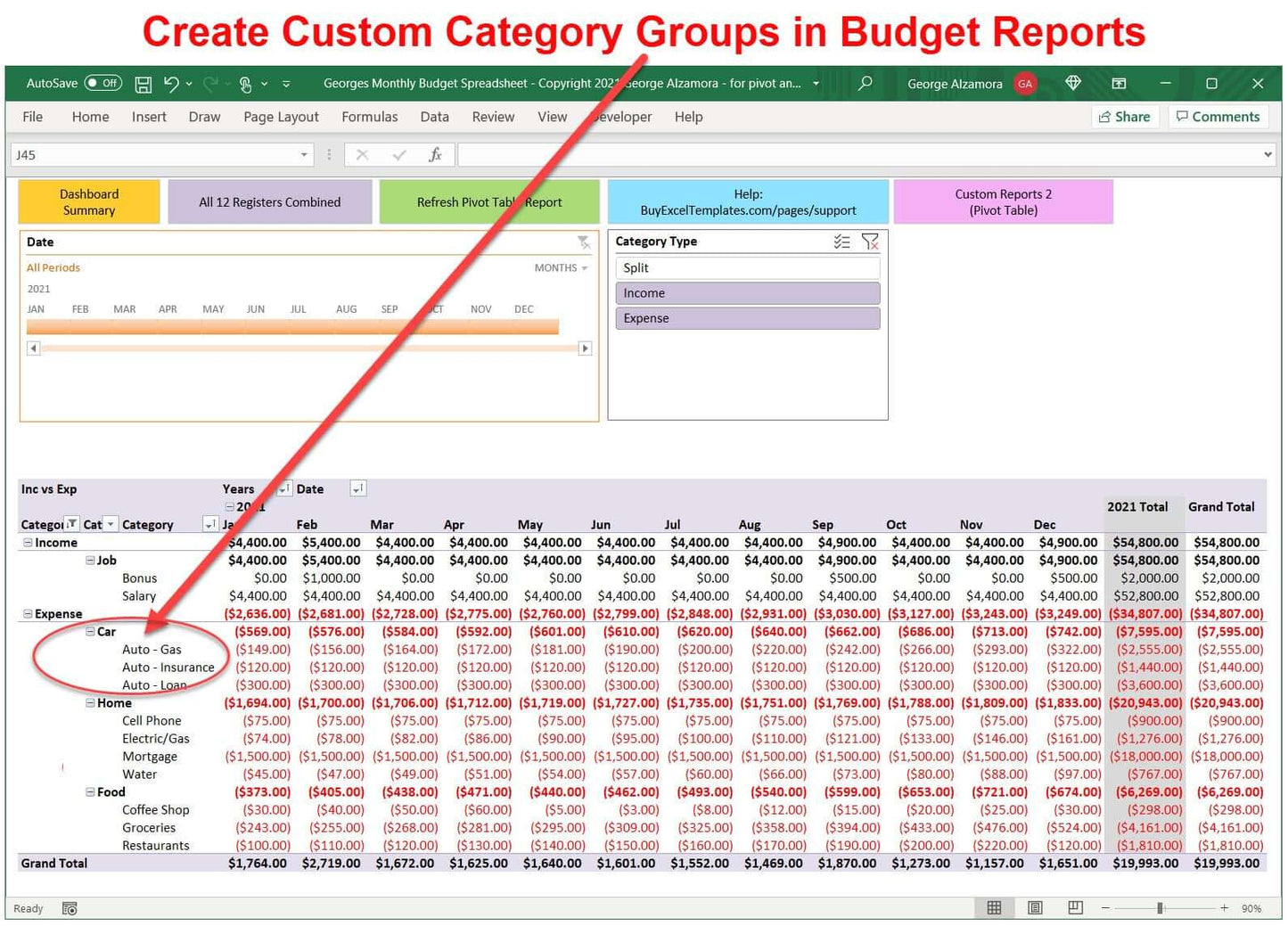

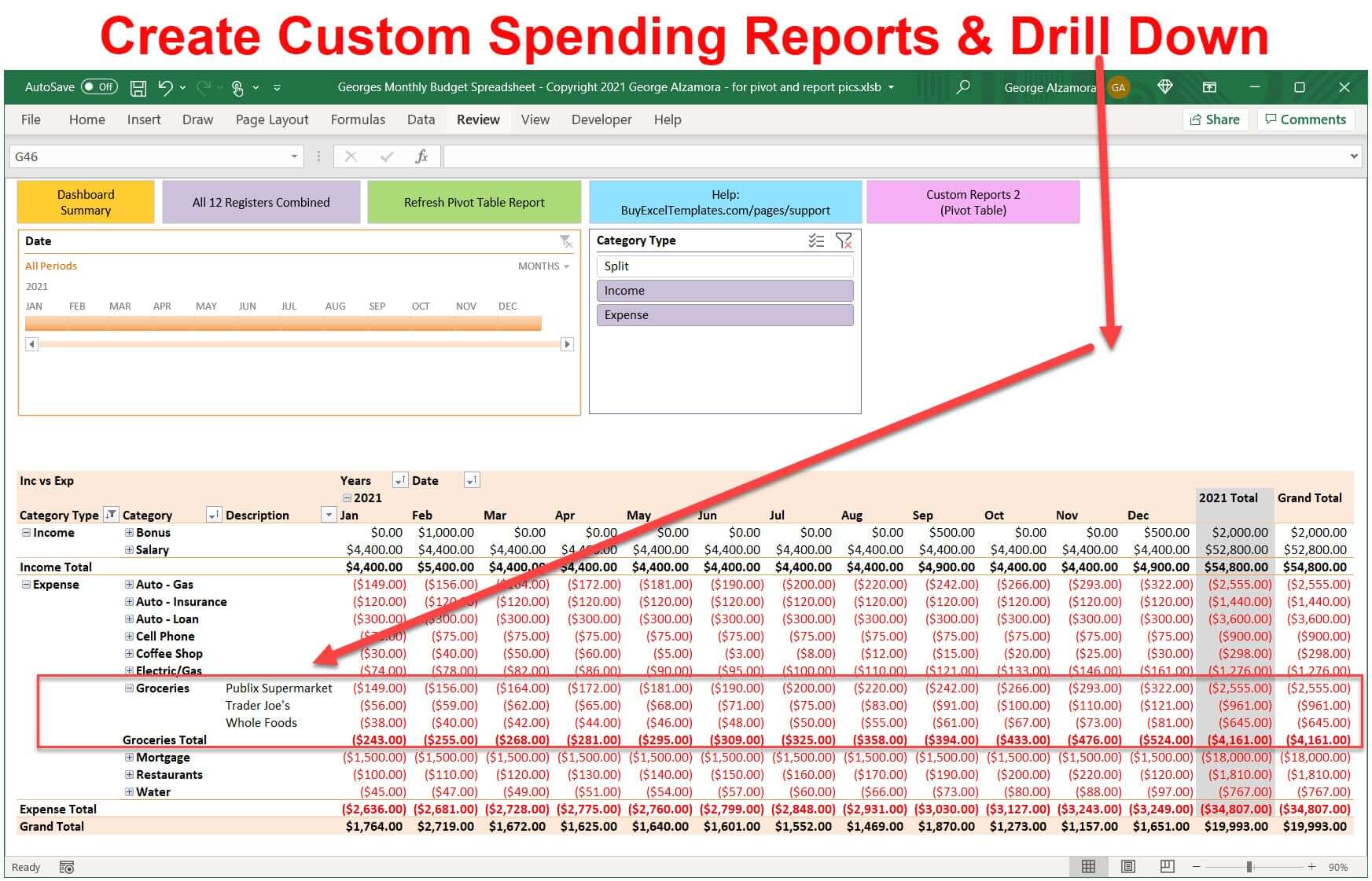

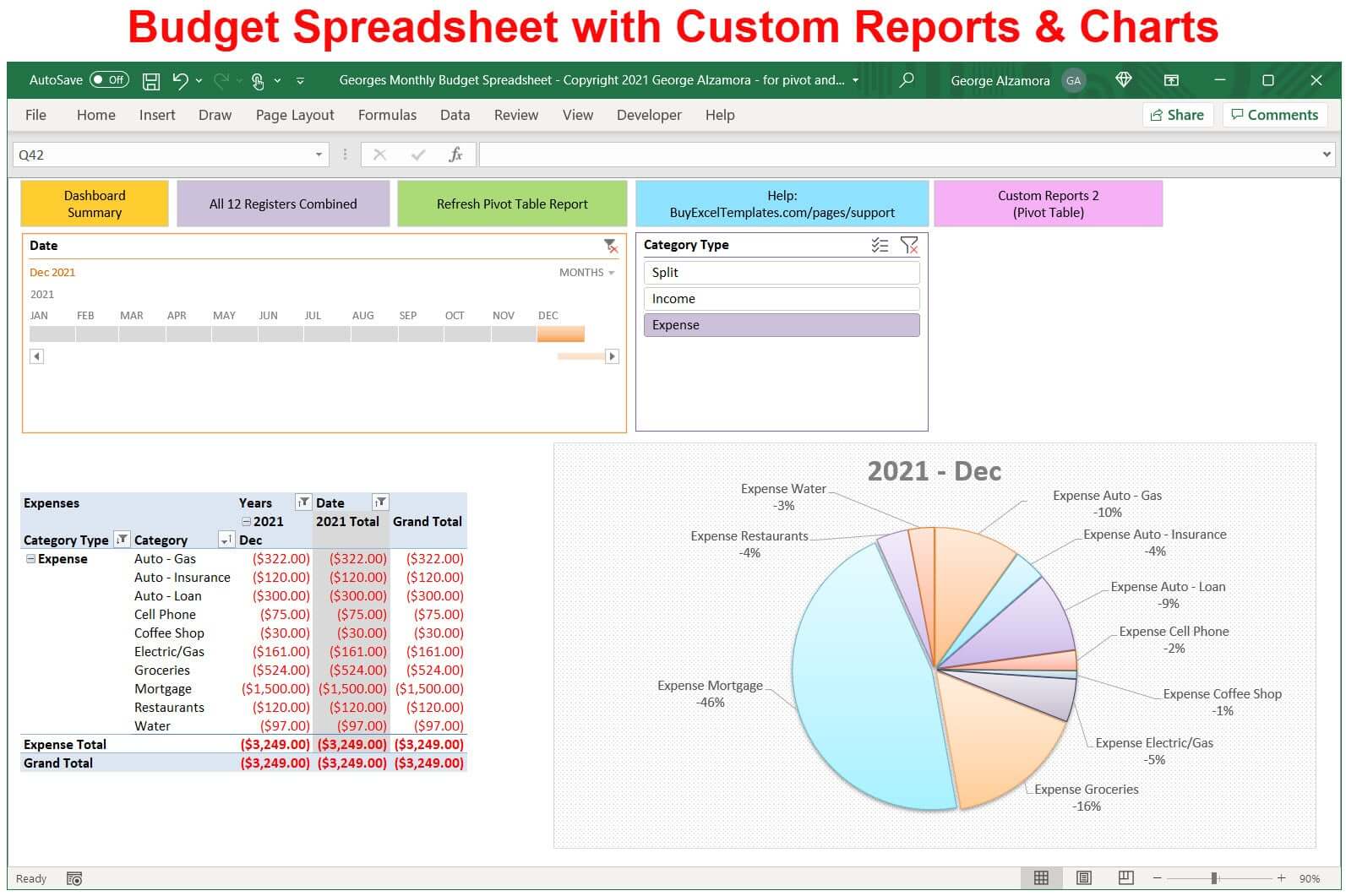

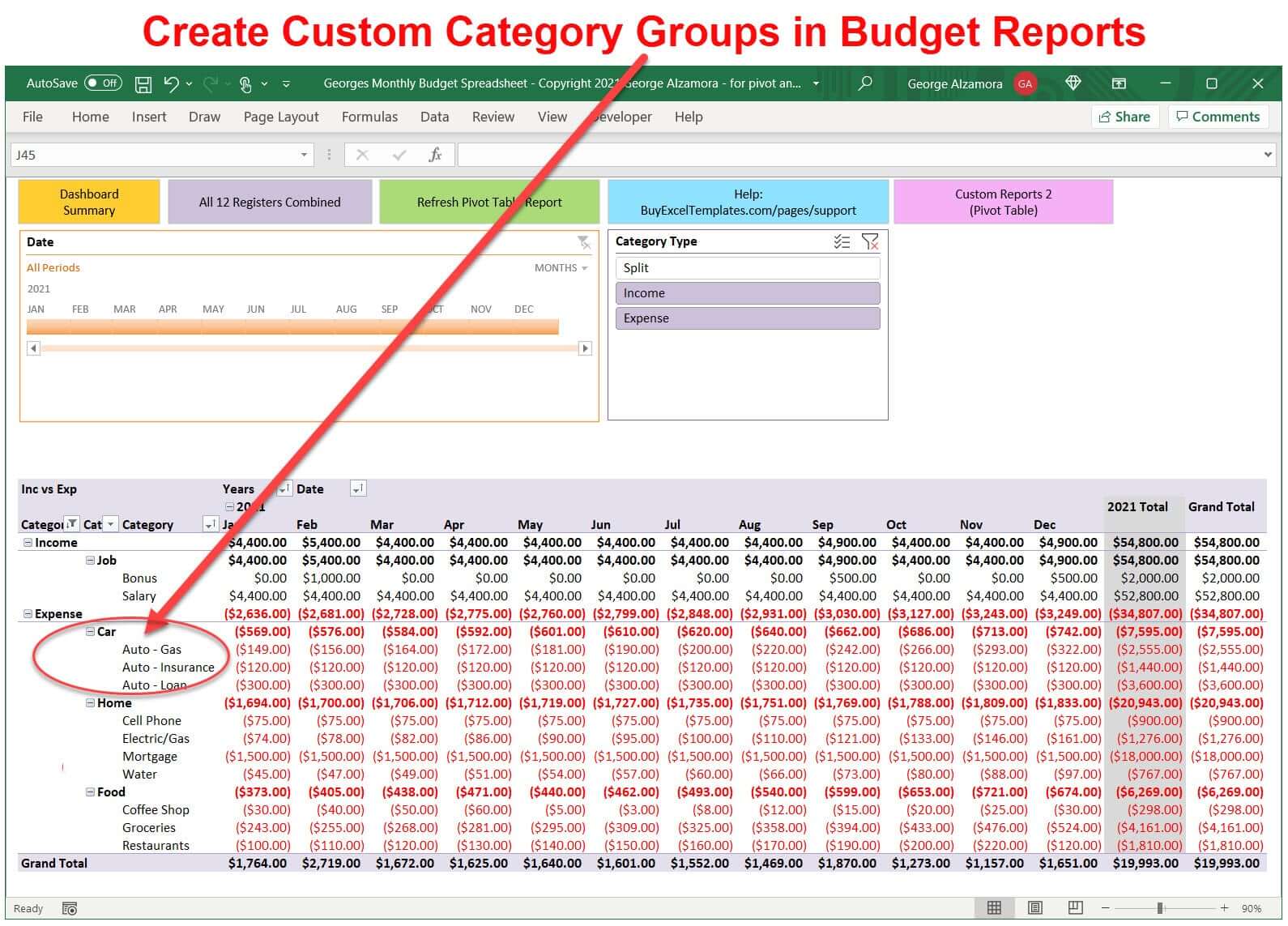

7. Customizable reports/charts such as monthly income vs spending reports and many more custom reports/charts that you can create and print such as expense reports based on the categories and descriptions (payees) assigned to a transaction. There are two separate unlocked worksheets, each with a pivot table tied to the master combined register, for you to create your custom reports and custom charts. You can create quarterly reports and full year reports and also group categories to create category and subcategory totals.

The household budget template (Georges Monthly Budget Spreadsheet v10) includes these separate worksheets in the Excel template:

- 12 month budget template - This worksheet is where you create your custom income and expense categories and set a 12 month budget for each category. For each category you can set a different monthly budget for each of the 12 months of the calendar year. For example, if you pay a particular bill on a quarterly basis, you can set the budget just for the months of January, April, July, October and set the other months at 0.00. You can use the same budget amount for a particular category each month, or if your budget for a particular category changes each month, you can set a different budget for each month of the year. The budget amounts that you set for each of the budget categories will be used to compare budget to actual amounts to help track your progress towards meeting your personal financial plans.

- January transaction register: enter actual income and expenses for the month of January and see January total income, January total expenses, and January net savings.

- February transaction register: enter actual income and expenses for the month of February and see February total income, February total expenses, and February net savings.

- March transaction register: enter actual income and expenses for the month of March and see March total income, March total expenses, and March net savings.

- April transaction register: enter actual income and expenses for the month of April and see April total income, April total expenses, and April net savings.

- May transaction register: enter actual income and expenses for the month of May and see May total income, May total expenses, and May net savings.

- June transaction register: enter actual income and expenses for the month of June and see June total income, June total expenses, and June net savings.

- July transaction register: enter actual income and expenses for the month of July and see July total income, July total expenses, and July net savings.

- August transaction register: enter actual income and expenses for the month of August and see August total income, August total expenses, and August net savings.

- September transaction register: enter actual income and expenses for the month of September and see September total income, September total expenses, and September net savings.

- October transaction register: enter actual income and expenses for the month of October and see October total income, October total expenses, and October net savings.

- November transaction register: enter actual income and expenses for the month of November and see November total income, November total expenses, and November net savings.

- December transaction register: enter actual income and expenses for the month of December and see December total income, December total expenses, and December net savings.

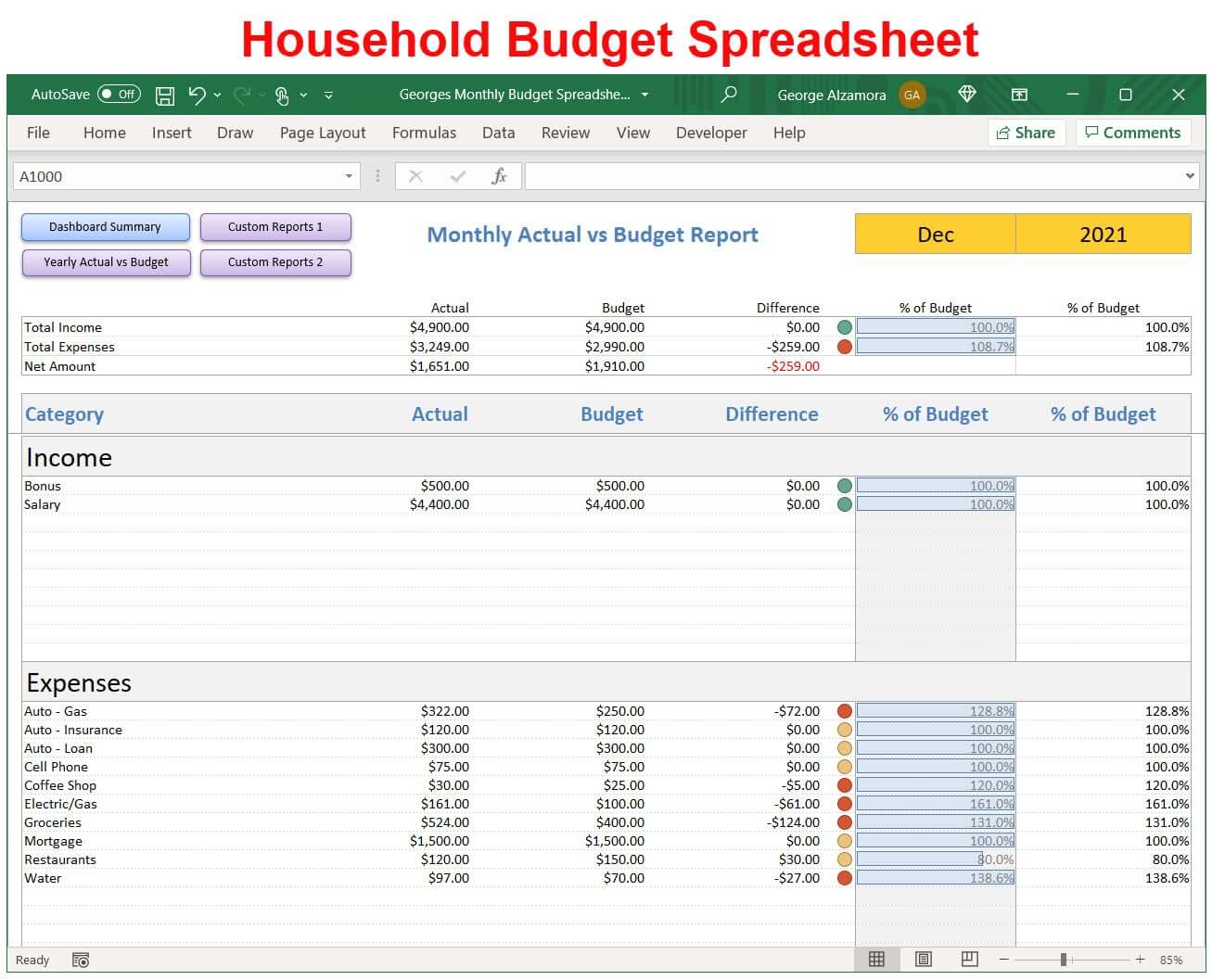

- Household monthly budget vs actual reports and charts for each category and for every month of the year.

- Household yearly budget vs actual reports and charts for each category

- Custom Income and Spending reports with detailed category totals for different time periods such as monthly and yearly spending reports.

The household budget log can be used for any calendar year however, you can only enter data for one calendar year at a time.

The Excel household budget template save you time and takes the guesswork of trying to figure out how to create a household budget template to track your budgeting. As soon as you download the household budget software, you can start creating your budget categories and assigning a monthly budget to each category and then entering your actual income and actual expenses into the monthly registers. Then just view the reports to see where you stand and make decisions on where to cut spending. The budget reports can be printed so the software can easily function as a printable household budget template.

The monthly household budget spreadsheet is a great Excel template to help you manage your personal budget whether your single on a budget, a couple on a budget, or on a college budget. The Excel household budgeting spreadsheet (Georges Monthly Budget Spreadsheet v10) is an easy money management tool to help your family stay on budget.

System Requirements:

- PC with Excel for Microsoft 365 (Excel for Office 365) (part of Microsoft 365 subscription / Office 365 subscription) or Microsoft Excel 2021

- Mac computer with Excel for Microsoft 365 for Mac (Excel for Office 365 for Mac) (part of Microsoft 365 subscription / Office 365 subscription) or Microsoft Excel 2021 for Mac

- The monthly budget template is supported in the United States, Canada, and Australia as the amounts are formatted with the $ symbol. The dates are formatted as MM/DD/YYYY.

- PC and Mac should have minimum 3 GHz processor, 8 GB RAM and SSD storage. The household budgeting spreadsheet (Georges Monthly Budget Spreadsheet v10) requires those specs to run properly due to large amount of Excel formulas.

- The monthly budget spreadsheet is not compatible with Google Sheets (Google Spreadsheets)

- The Excel monthly budget template is not compatible with Microsoft's free "Excel Online" app that is part of the free Office Online apps. These online apps are web browser based and have limited features compared to the full desktop version of Microsoft Excel.

License Terms:

By purchasing you agree with the License Terms / Terms of Sale.

Excel is a registered trademark of Microsoft Corporation