Simple online personal net worth calculator to see where you stand financially at a particular point in time. Start tracking your net worth and see if you are growing your wealth.

How to calculate your personal net worth

What is personal net worth? Personal net worth is calculated by taking the total value of all your assets (things that you own such as your home) and subtracting your total liabilities (things that you owe such as credit card debt) and the result is your personal net worth. A easy way of looking at the net worth formula is Assets - Liabilities = Net Worth. It is also known as your personal balance sheet.

Try the online Net Worth Calculator now below...

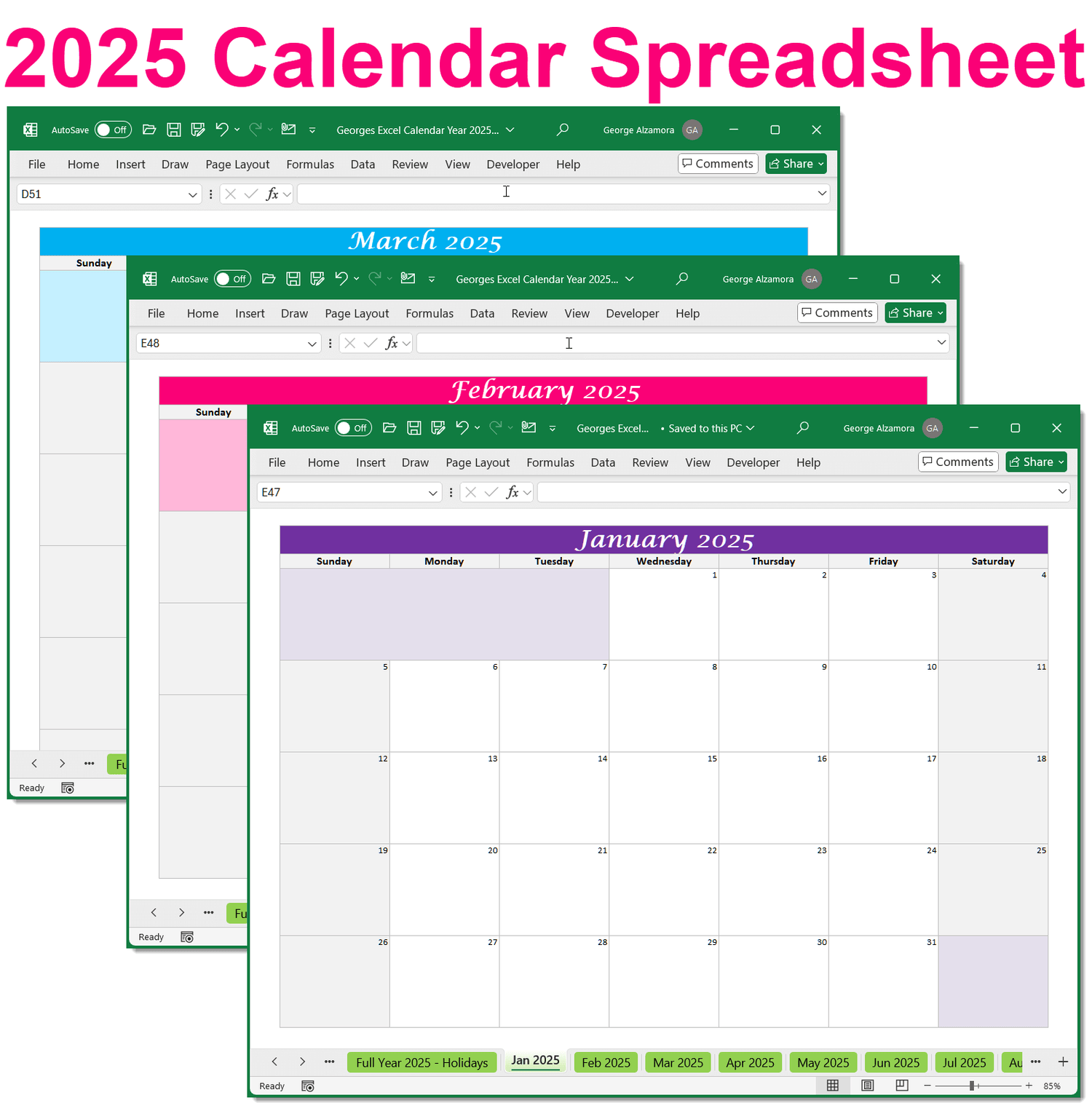

Purchase the Excel net worth calculator spreadsheet if you want to use the net worth calculator as an Excel template on your own computer and save and print the your personal net worth results. See our advanced net worth calculators that will track your net worth over time and have additional spreadsheet features such as checkbook registers and personal budgeting.

Net Worth: Examples of Assets (things you own)

Assets can be categorized in different categories. For example, there are liquid assets but such as cash and checking account balances that are available to you right away. Other assets that are not liquid are for example a home which must be first sold in order to have access the its cash value.

- Cash on hand

- Checking Account Balances

- Savings Account Balances

- Money Money Market Account Balances

- Certificate of Deposits

- Home (Current market value of your home)

- Second Home

- Vacation Home

- Investments Properties

- Home Furnishings

- Art

- Jewelry

- Other collectibles

- Computers / Tables / Electronics

- Mobile Cell Phones

- Tools

- Other personal valuables

- Cars (Current Market Value)

- Motorcycles

- Boats

- RV's (Recreation Vehicles

- Other Motor Vehicles

- 401K Account Balances

- Traditional IRA Accounts / Roth IRA Accounts

- Other Retirement Accounts

- Pension/Profit sharing plans (current value if you were to cash out today or present-day value)

- Gold, Silver and other precious metals

- Stock Investments

- Bond investments

- Mutual Funds

- Cash Surrender Value Of Whole Life Insurance Policy

- Cash Surrender Value Of Annuity

- Value Of Business Ownership Interests

- Personal Loan Receivables (Money lent out that you expect to be fully returned)

- Other Assets

Net Worth: Example of Liabilities (things you owe / debts)

- Mortgage Loans

- HELOC Balances (Home Equity Line of Credit)

- Investment Property Loans

- Personal Loans

- Car Loans

- Credit Card Debt

- Student Loans

- Other loans

- Medical Debt

- Other Liabilites

If you are calculating your net worth for your own benefit, its up to you how to decide what things you want to include in the net worth calculations and how often you want to track your net worth. For example, when it comes to assets, you may decide to exclude your personal belongings that are less than a certain value such as $100.00. Also, certain assets are easy to determine their value, such as your balances in your bank accounts. However, other assets such as your home are not as easy since determining its current market value would require an appraisal where the appraiser looks at similar home sales and other factors to determine a homes market value. Another option is to estimate the value yourself by looking up recent home sales in your local property appraisers online website.

How often you determine your net worth is up to you. You may decide to track your net worth on a monthly basis, quarterly basis or yearly basis. There are some online net worth trackers that can make the process easier since they are linked to many of your financial accounts.

Also, does the net worth tracker take into affect taxes or fees (for example taxes on assets sold or if selling your home, fees to sell home such as realtor fees which are typically 6% of the sale price.

Your personal net worth or personal balance sheet is calculated at a specific date (point in time). So your net worth can change from one date to another based on changes in the value of your assets or how much debt you have paid down or taken out. For example, your home value may increase over the next year, so if all your other assets and liabilities stayed the same for that year, then your personal net worth would have increased due to the increase in the current market value of you home at that time.

Why calculate your personal net worth

One of the goals in building personal wealth and becoming financially independent is to grow your personal net worth. You can grow your net worth by increasing your assets (things that you own) and if you have liabilities, paying down your debts or paying off your debts.

You could have a negative net worth where your liabilities are greater than your assets. However, you can go from negative net worth to positive net worth by increasing your assets and paying down your debts. Some people whose negative personal net worth is to big, due to high credit card debt with very high interest rates or unexpected large medical bills due to illness may consider bankruptcy to either discharge their debts or reorganize their debts to make them more manageable to pay relative the their income that they make.

Whether you are high net worth individual with liquid assets of greater than one million or someone with negative net worth trying to pay down debt, it is important to record all your assets and liabilities at different points in time to see where you stand with your personal finances and set financial goals to grow your net worth and pay down debt whether the debt is student loads or credit card debt that has the potential to have high interest rates and would therefore be harder to pay down since much of the payment would go to interest expenses

Ways to grow your personal net worth

You can grow you assets by increasing your income. Increase your job skills through education and get a higher paying job or ask for a raise. Take a second job to supplement your income.

Start a business and build it into a profitable business. Be wise as you do not want to continue a business that just drains your hard earned assets and savings and never earns a profit. You can turn your hobby into a business or start an online business such as a drop shipping business. With the currently technology, there are many business that you can work at home. Build a business that has value and can be sold whether you are a sole proprietor or form an LLC or incorporate your business.

Invest your money wisely in assets that can grow over time such as investment property, rental property, stocks and bonds, collectibles such as collective cars. It is important to diversify your investments so that all of your money is not in just one or two areas.

Even thought you might have a job and are making good money, you should still budget your money whether you use personal budget software, a budget app on your phone, or a budget spreadsheet using Excel. Budgeting can help you set budget limits, see where you are spending your money, and cut spending if you are over spending on your monthly budget. Budgeting can help you save more and build more assets.

You can reduce your liabilities by paying down your debts especially those that carry the potential for high interest rates.

Summary

Calculating your personal net worth is important to see if you are reaching your financial goals, whether it is to grow your assets over a period of time and to pay down your liabilities. It can also be a reality check if you see your credit card debt balances increases over time. Whether you use a free online net worth calculator tracker or a free net worth calculator Excel template spreadsheet, your personal balance sheet is tool to help you manage your personal finances. A personal net worth statement gives you a big picture of where you stand financially and can help you set goals and limits when doing your monthly personal budgeting whether its cutting back on spending or finding ways to make more money.